The industrial vacancy rate has dropped in Arkansas, indicating recovery of the local economy and opportunity for commercial real estate development.

Although you could not call the recovery extremely robust, the 2014 economy in Arkansas is much better than it was five years ago. When the economy is firing on all cylinders, prime commercial real estate becomes difficult to find as new businesses are anxious to find suitable locations and existing businesses often look to expand their operations. As the industrial vacancy rate drops, demand for the services of a professional Arkansas commercial appraiser increases as activity in the commercial real estate segment grows.

Industrial Vacancy Rate

Land or buildings used for industrial purposes, or suitable for use for industrial purposes, is commonly known as industrial real estate. This real estate category includes property that is used for production, manufacturing, assembly, warehousing, research, light storage, and distribution.

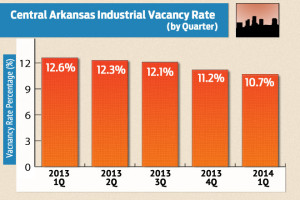

The vacancy rate for industrial real estate is a good indicator of the health of the local, state, or national economy. A low or declining vacancy rate is positive for the economy because it conveys that business activity is picking up. On the other hand, a high vacancy rate suggests the economy is weak and demand for manufactured goods and other products is down. Central Arkansas, like much of the rest of the country, has seen a substantial decline in the industrial vacancy rate from the first quarter of 2013 to the first quarter of 2014:

- Q1 2013 – 12.6%

- Q2 2013 – 12.3%

- Q3 2013 – 12.1%

- Q4 2013 – 11.29%

- Q1 2014 – 10.7%

Although the Central Arkansas industrial vacancy rate has declined by 1.9% from the first quarter of 2013 to the first quarter of 2014, it is still resting above the national average industrial vacancy rate of 9%.

Commercial Real Estate Values

New construction in commercial real estate has been weak over the last several years. The relative lack of new development in the form of new warehouses, manufacturing facilities, and other industrial space, has limited the supply of properties for new businesses and business expansion to existing inventory. In the Little Rock area, for instance, total new supply in the first quarter of 2014 was at just 18,376 square feet and there were no new projects under construction.

When an Arkansas commercial appraiser assesses the market, they consider the comparable sales and specific features of each property. While 187,000 square feet of industrial space was absorbed in the Central Arkansas market in the first quarter of 2014, the reduction in supply did not materially impact square footage rates.

Parties interested in buying or renting property intended for industrial use will find lower rates per-square-foot on existing properties than on new construction. As long as the vacancy rates continue to trend down, and the Arkansas economy continues to improve, the demand for warehouse and other industrial space will start to exceed supply. More developers will step into the market to meet that demand and existing properties will eventually cost more per-square-foot.

Arkansas commercial appraiser, Ferstl Valuation Services, can assist you in valuing the property you own or the property you are considering for purchase. Contact us for a commercial real estate appraisal, or call our Little Rock office at 501-313-0641 or Northwest Arkansas office at 479-595-0245 to get started.

Leave a Reply

You must be logged in to post a comment.